Board President’s Post

LivingPower Newsletter, Sept./Oct. 2022

Almost every month, it seems North Carolina is named “best” or is given another lofty ranking by some group. Just recently, CNBC named North Carolina the best place for business. The Old North State is almost always named one of the finest places to live and retire. Those admirable rankings take into consideration tax rates, affordable housing, and a readily available workforce, but they also consider services such as education (from Pre-K to universities and colleges), health care, libraries, recreation, transportation and cultural opportunities. One factor those last amenities have in common is most are staffed and led by public servants, from school teachers to

public health nurses and technicians to librarians, as well as professionals in numerous other public service fields.

Whether current public servants or those of us retired, we all played a role in our state obtaining those distinguished rankings and national

attention. We have “all been warmed by fires we did not build, and have drunk from wells we did not dig.” I am both a community college graduate (Lenoir Community College, 1971) and a retiree from that system, having spent 32 years working at four different colleges in the 58-college system. As a student, I benefited from those who came before and created what is one of the best community college systems in the country. In my career, I tried to pay back those previous public servants and helped to continue building a system of excellent two-year colleges for future generations.

The same is true for our NCRGEA members as well as all state and local government retirees. In whatever career path you followed as a state or local government public servant, you contributed to our state’s success. One of our NCRGEA goals this year is to gently remind decision-makers that all of us — current public servants and retirees — played a role in our state’s success and should benefit accordingly.

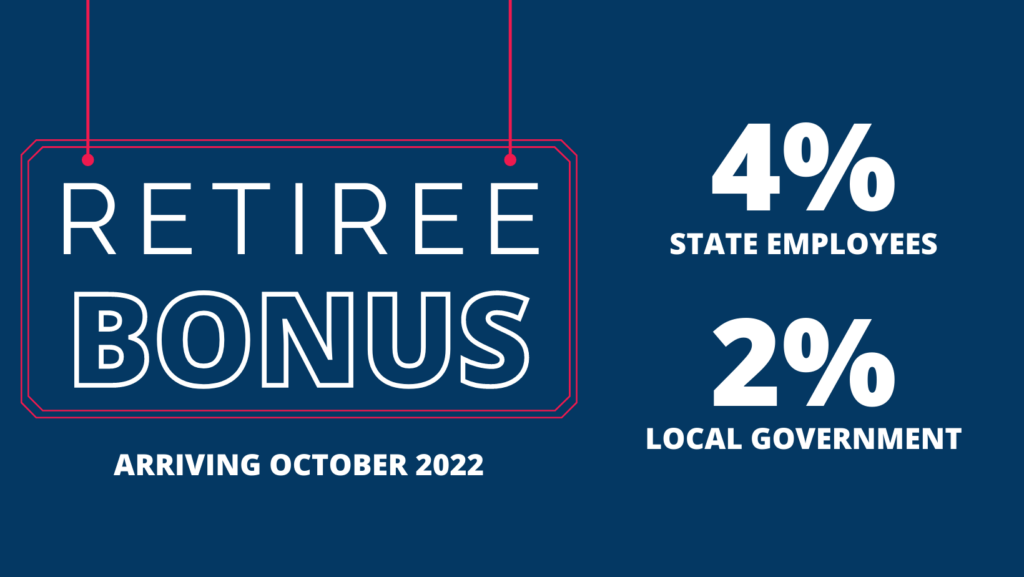

Over the past two years, there have been bonuses for retirees. Last year, state retirees received a 2 percent bonus in December and this year will receive a 4 percent bonus in October. Meanwhile, in January, the Local Government

Retirement Board of Trustees approved a 2 percent bonus, to be paid in October, for local governmental retirees. Those extra dollars from the General Assembly and Local Government Retirement Board are appreciated, but clearly more needs to be done, especially for local government retirees. All retired public servants deserve a cost-of-living increase. Inflation does not distinguish between those employed and those retired, and the value lost since the great recession has stripped retirees of a lot of purchasing power.

Current state and local government employees deserve their recent raises. As the state does well, public servants should be rewarded appropriately. However, today’s success is built on a solid foundation laid by our retirees, and those retired public servants should be remembered, as well, with cost-of-living raises. North Carolina’s current

success has been a team effort, and the entire team should benefit from these achievements.